The digital revolution has ushered in a transformative era for the financial sector, with emerging technologies like cryptocurrency challenging the traditional boundaries of monetary systems. Facebook’s ambitious venture into this space with the introduction of its Libra project has ignited a worldwide debate, filled with a mixture of anticipation and concern. This debate has attracted the attention of some of the most prominent economists, including Nobel Prize laureate Joseph Stiglitz, whose critical views on Libra and cryptocurrencies at large have sounded the alarm regarding the potential impact these digital assets may have on the global financial structure.

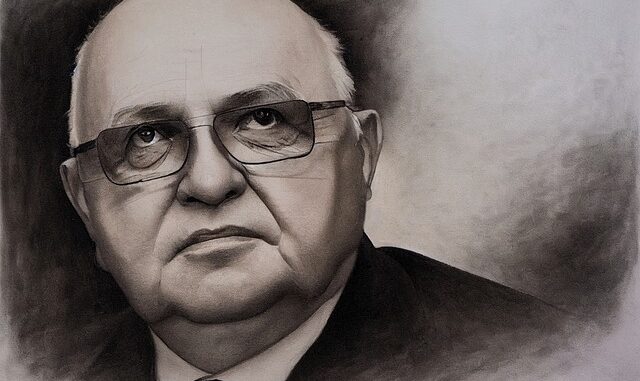

Joseph Stiglitz, renowned for his sharp critiques and his readiness to challenge existing financial frameworks, has become a key figure in the rigorous evaluation of Facebook’s Libra. His expertise, honed through years of research and academic distinction, offers a sober perspective on the future and desirability of cryptocurrencies. In a pointed critique published in MarketWatch, Stiglitz articulates a comprehensive challenge to Libra’s credibility, questioning its capacity to serve as a stable and reliable currency.

At the heart of Stiglitz’s argument is an examination of the core attributes required for stable money, which, in his view, cryptocurrencies like Libra conspicuously lack. His skepticism is not limited to Libra; it extends to bitcoin and other cryptocurrencies, which he believes could create more issues than they resolve. Even stablecoins, which are designed to maintain a steady value by anchoring themselves to fiat currencies, fail to mitigate his concerns.

The unease Stiglitz expresses about Libra’s potential effects on financial institutions and sovereign governments is evident. He warns that Libra could weaken the influence of central banks and disrupt the established financial order. Despite Facebook’s commitments to regulation and a foundation of fiat currency support, Stiglitz remains skeptical. His reservations paint a scenario of ambiguity concerning the tech behemoth’s ability to manage a financial initiative with such transformative potential responsibly.

Stiglitz’s critique transcends academic commentary; it is a stark caution to investors, policymakers, and the general public. He urges for increased vigilance and a discerning approach to the intricacies and uncertainties within the cryptocurrency domain. The dangers and challenges posed by digital currencies like Libra, according to Stiglitz, should not be taken lightly.

In a broader context, Stiglitz calls for a complete prohibition on cryptocurrencies, indicative of his overarching concern for the stability of the world’s financial systems. He predicts more harm than good from the widespread adoption of digital currencies and supports a financial infrastructure that upholds security, stability, and transparency. His stance is that fiat currencies, backed by government authority and central banking mechanisms, are the most reliable forms of money.

The narrative that Stiglitz weaves regarding Facebook’s Libra project extends beyond the realms of economic theory; it serves as a plea for measured and cautious progression in the adoption and integration of digital currencies into the financial framework. As the argument over the future of money rages on, Stiglitz’s insights stress the importance of safeguarding consumer interests, maintaining financial stability, and preserving the fabric of the international financial network.

The complexities and uncertainties surrounding ventures like Libra underscore the imperative for a deliberate and informed exchange among financial stakeholders. As we navigate this new frontier, the wisdom of experts such as Stiglitz is invaluable in shaping a future where digital and traditional currencies can coexist, without undermining the bedrock of our economic systems. Stiglitz’s input into the conversation on digital currencies acts as a beacon, steering us towards a financial future that protects the interests of all parties in a rapidly changing world.

Be the first to comment