Seated across from me in his tastefully decorated yet unpretentious office, Dr. Orhon Can Dagtekin exuded a quiet confidence. As an assistant professor at Ankara Haci Bayram Veli University with an extensive background in Economics and Financial Engineering, his insights into the cryptocurrency market were profoundly informed and intricately fascinating. Our conversation was particularly timely, given the imminent U.S. elections, an event notorious for sending shockwaves through global markets.

“The volatile nature of bitcoin and the intense reactions of cryptocurrency markets to world events—whether political or financial—are well known by now,” Dr. Dagtekin began, setting the stage for our discussion. Indeed, in an era where news travels faster than ever, price movements in the cryptocurrency market can occur almost instantaneously. This market operates 24/7 on an entirely digital infrastructure, making it uniquely susceptible to any form of disruption.

Dr. Dagtekin leaned forward, his eyes sparkling with interest. “With the election campaign in full swing, U.S. politics and official statements can single-handedly determine the short-term trajectory of bitcoin and the broader cryptocurrency market.” The U.S., a major economic player, holds significant sway over global financial systems, including cryptocurrency. Bitcoin’s emergence as an alternative to the central banking system has always been a double-edged sword. “The 2009 financial crisis was a critical juncture,” Dr. Dagtekin noted. “It led to the birth of bitcoin, a response to inflationary pressures and government bailouts. Its early years were relatively uneventful, flying under the regulatory radar—until its association with money laundering on platforms like Silk Road complicated its image.”

The narrative shifted as bitcoin transitioned into a mainstream investment tool, closely watched by U.S. decision-makers. The introduction of other cryptocurrencies like Ethereum and Ripple added layers of complexity to the regulatory landscape. “U.S. sanctions decisions are a pertinent example,” Dr. Dagtekin explained. “Even if policies or regulations do not directly target bitcoin, price shocks can occur indirectly.” He cited historical instances where sanctions, typically imposed by the U.S., led to significant price declines in cryptocurrencies. Countries such as Russia, Iran, and Venezuela turned to crypto assets to circumvent these economic barriers, causing ripples in the market. “Sanctions create uncertainty and downward pressure on cryptocurrencies, but they can also drive adoption in sanctioned countries as the public seeks to mitigate economic risks,” he said.

Our discussion naturally gravitated towards the roles of the Federal Reserve and the U.S. Securities and Exchange Commission (SEC). “The Fed and the SEC are pivotal in this context,” Dr. Dagtekin emphasized. “Federal Reserve decisions on interest rates and money supply indirectly affect crypto prices, while SEC regulations can cause significant volatility.” He mentioned how past statements from SEC Chair Gary Gensler and recent vetoes from President Biden have had stark impacts on crypto prices. “Considering Trump’s approach to the Federal Reserve during his campaign, a Republican victory could be a catalyst for sharp price action in many markets, cryptocurrencies included,” he mused.

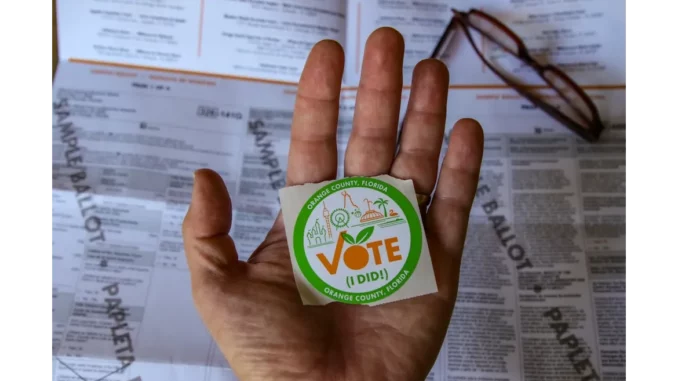

As we delved deeper into the potential impacts of the upcoming elections, Dr. Dagtekin highlighted the uncertainty that surrounds such periods. “Different candidates’ stances on crypto can significantly affect investor sentiment,” he said. “El Salvador’s President Nayib Bukele declaring bitcoin as legal tender is a prime example of how political decisions can boost crypto prices.” In the U.S., the economic capacity allows decision-makers to steer prices with relatively little effort. “Recent events, like the assassination attempt on Trump and Biden’s decision to quit the race, have already shown how sensitive the market is to political developments,” he pointed out. “These short-term movements signal to investors worldwide the candidates’ stances on cryptocurrencies.”

Dr. Dagtekin elaborated on how Biden’s administration has typically taken a cautious, regulation-focused approach, perceived as less crypto-friendly. “On the other hand, Trump’s stance has shifted from initial opposition to a more supportive attitude towards the crypto industry,” he said. “Recent market reactions may be reflecting this change.” As our conversation drew to a close, Dr. Dagtekin underscored the importance of clear policy stances. “Even a single hour is a very long period in the market. Uncertainty may persist until the elections end, but a clear stance by U.S. policymakers can help stabilize the market in the long run, regardless of the winning candidate’s position on bitcoin.”

Leaving Dr. Dagtekin’s office, I couldn’t help but reflect on the intricate dance between U.S. politics and the cryptocurrency market. The upcoming elections promise to be a critical juncture, potentially setting the stage for another wild ride in the world of digital assets. For now, all eyes remain on the candidates, their policies, and the market’s reaction to every move.

Be the first to comment