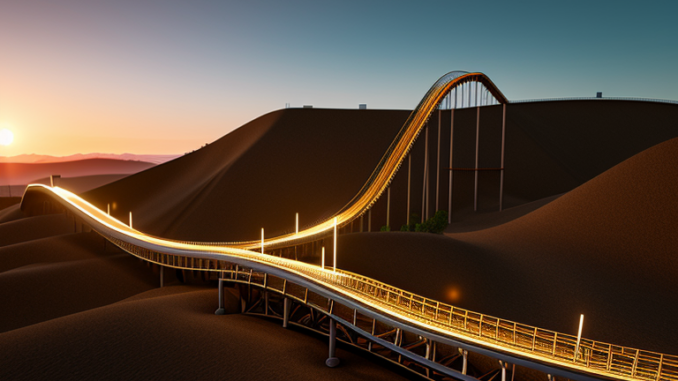

The world of cryptocurrencies is a fast-changing and fast-paced environment, where investors and traders face continuous challenges and opportunities. With unpredictable behavior and significant price swings, the cryptocurrency market requires a cautious and strategic approach. To succeed in this highly volatile environment, individuals must adopt a long-term investment strategy while being mindful of the various obstacles ahead.

Similar to traditional stocks, cryptocurrencies are influenced by macroeconomic factors. Economic indicators like interest rates, inflation, and geopolitical events can greatly impact the value of digital assets. It is important to understand and monitor broader economic conditions when investing in cryptocurrencies.

While Bitcoin, the first cryptocurrency, has gained significant attention due to its extreme volatility, experts predict that as cryptocurrency markets evolve and regulations become clearer, Bitcoin’s volatility may gradually decrease. This change could bring stability to the market, making it more attractive to cautious investors.

It is worth noting that alternative cryptocurrencies, or altcoins, often follow the lead of Bitcoin. As the dominant player in the market, Bitcoin’s movements influence trading activity and sentiment around other digital assets. Therefore, when Bitcoin experiences significant price movements, investors reassess their positions in other cryptocurrencies.

Government regulatory announcements or crackdowns also play a crucial role in shaping the cryptocurrency market. The regulatory landscape surrounding cryptocurrencies is still uncertain, with different jurisdictions taking various approaches. A single government announcement or action can trigger a ripple effect, causing prices to rise or fall.

Changes in investor sentiment and attitudes are another driving force behind cryptocurrency market movements. As the market is still relatively young and speculative, emotional reactions and external factors can have a significant impact on prices in a short period of time. Traders and investors must be cautious and constantly monitor market sentiment to make informed decisions.

Despite the inherent volatility, periods of low volatility are not uncommon in the cryptocurrency market. Currently, Bitcoin and various cryptocurrencies are experiencing a period of relative stability. However, due to the speculative nature of these digital assets, some level of volatility is expected to persist.

The road to a more stable cryptocurrency market lies in the involvement of institutions, regulatory acceptance, and widespread adoption. As more institutions enter the space, regulatory frameworks become clearer, and cryptocurrencies gain mainstream acceptance, the market is expected to become more stable. This could create a better environment for long-term investors looking to take advantage of the potential of digital currencies.

Technological advancements within the Bitcoin ecosystem also have the potential to influence its price. As the underlying technology evolves and new solutions are developed, market participants closely monitor these advancements, which can impact the value of Bitcoin.

In recent months, Bitcoin’s rapid rise has highlighted both the unique challenges and opportunities of the cryptocurrency market. The extreme price fluctuations seen during this period have reinforced the need for a long-term investment strategy. While short-term gains may be tempting, focusing on the underlying fundamentals and future potential of cryptocurrencies is crucial for investors.

In conclusion, navigating the volatile cryptocurrency market requires a careful balance of caution and long-term vision. Understanding the macroeconomic factors influencing the market, monitoring regulatory developments, and being cautious of emotional reactions are all crucial for success. As the cryptocurrency market continues to evolve, investors and traders must adapt their strategies to seize opportunities and overcome the challenges presented by this dynamic and ever-changing environment. By staying informed and adopting a strategic approach, individuals can make the most of the opportunities and thrive in the volatile cryptocurrency market.

Be the first to comment