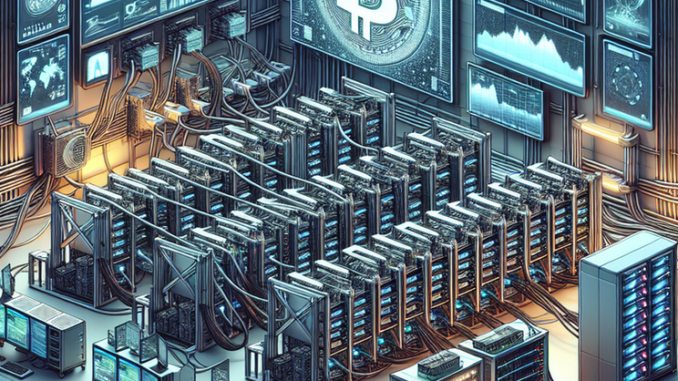

Bitcoin, the well-known digital currency, has gained attention due to its decentralized structure and strong security. However, the rise of centralized Bitcoin mining pools poses a danger to these important aspects. The concentration of power among a few pools raises concerns about manipulation, control, and the overall security and decentralization of the network.

The Overwhelming Dominance:

Critics have expressed concerns about the overwhelming dominance of Bitcoin mining pools. Currently, Foundry USA and AntPool control a large 55% of Bitcoin’s hash rate, which raises worries about potential manipulation and control. This concentration of power has far-reaching implications for the security and decentralization of Bitcoin.

Incidents and Their Implications:

Recent incidents involving F2Pool and AntPool have highlighted the risks associated with centralized mining pools. These incidents have had negative effects on miners and transactions, casting doubt on the reliability and stability of the Bitcoin network. Such events undermine trust in Bitcoin and raise questions about transaction security.

Transparency and Fairness Concerns:

One concerning aspect is the arbitrary decision-making by mining pools regarding payment to miners. Instances have occurred where pools chose not to pay their miners, depriving them of their rightful rewards. This lack of transparency and fairness undermines the principles of trust and equity on which Bitcoin was founded.

The Threat to Security:

The centralization of Bitcoin mining pools gives a single coordinator control over block creation and transaction filtering, directly impacting network security. A newly established Bitcoin mining pool faced accusations of deliberately filtering privacy-related BTC transactions, highlighting the risks associated with a centralized coordinator. Such centralization undermines Bitcoin’s security, which relies on the Proof-of-Work (PoW) consensus mechanism.

Long-Term Implications:

The dominance of mining pools poses a threat to the decentralization that makes PoW effective. Prominent crypto researcher Chris Blec has expressed concerns about the long-term security implications of this centralization. It is important to address this issue to ensure the long-term success and sustainability of Bitcoin.

Lack of Awareness:

Many Bitcoin investors are unaware of the risks associated with centralized mining pools. The concentration of hash rate among a few pools not only affects transactions but also impacts the market’s perception of Bitcoin’s value. Investors’ capital is at risk in an environment where centralized control can significantly impact network stability and security.

Finding Solutions:

Addressing the dominance of mining pools requires collaborative efforts from the Bitcoin community. It is crucial to explore alternative consensus mechanisms or foster the growth of smaller, more distributed mining pools. By promoting decentralization, fairness, and transparency, the community can mitigate the risks associated with centralized mining pools and ensure the trust of Bitcoin users.

Preserving Bitcoin’s Value Proposition:

Bitcoin’s value lies in its security and decentralization, setting it apart from traditional financial systems. It is essential for the community, developers, and regulators to prioritize efforts in mitigating the risks associated with centralized mining pools. By doing so, Bitcoin can maintain its position as the leading cryptocurrency while ensuring the trust of its users.

Conclusion:

The dominance of centralized Bitcoin mining pools poses significant threats to the security and decentralization of the network. Urgent action is needed to address this issue, considering incidents affecting miners and transactions. The Bitcoin community must collaborate to find innovative solutions that preserve the core principles of Bitcoin. By doing so, Bitcoin can fulfill its potential as a secure and decentralized digital currency, maintaining its position as a global leader in the cryptocurrency market.

Be the first to comment