In the ever-evolving world of cryptocurrency, investors often grapple with the challenge of constructing portfolios that balance potential returns with manageable risk. Traditional investment strategies, such as the Markowitz Portfolio Theory, have been adapted to the crypto market, but they often rely on assumptions that may not hold true in this volatile space. A promising alternative is the network-based strategy, which leverages the complex interdependencies between cryptocurrencies to build more robust portfolios.

Understanding Network-Based Strategies

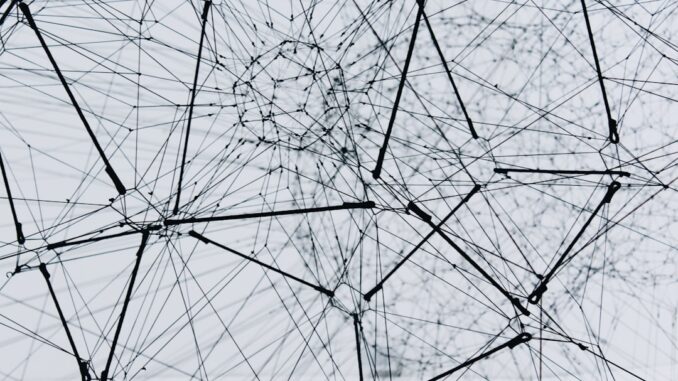

At its core, a network-based strategy involves representing cryptocurrencies as nodes in a network, with edges denoting the strength of correlations between their price movements. By analyzing this network structure, investors can identify clusters of cryptocurrencies that move similarly, allowing for the selection of assets that are less correlated with each other. This diversification can potentially reduce portfolio risk and enhance returns.

Investor Identification, Introduction, and negotiation.

Constructing a Network-Based Portfolio

-

Data Collection: Gather historical price data for a broad set of cryptocurrencies. Ensure the data spans a significant period to capture various market conditions.

-

Correlation Analysis: Calculate the correlation coefficients between the price movements of each cryptocurrency pair. This step quantifies the degree to which two cryptocurrencies move in tandem.

-

Network Construction: Transform the correlation matrix into a network, where nodes represent cryptocurrencies, and edges represent the strength of their correlations. A higher correlation results in a stronger edge between nodes.

-

Community Detection: Apply algorithms like Louvain or Affinity Propagation to detect communities or clusters within the network. Cryptocurrencies within the same community are highly correlated, while those in different communities are less so.

-

Asset Selection: From each identified community, select cryptocurrencies that are central to the community but not overly correlated with assets in other communities. This approach ensures diversification across the portfolio.

-

Portfolio Optimization: Utilize the Markowitz Portfolio Theory to determine the optimal allocation of selected assets, aiming to maximize expected returns for a given level of risk.

Case Study: Network-Based Portfolio Performance

A study by Jing and Rocha (2023) applied this network-based strategy to a dataset of 46 cryptocurrencies. The researchers constructed portfolios that outperformed traditional benchmarks, achieving up to a 1,066% average expected return within a single day. This performance underscores the potential of network-based strategies in capturing the complex dynamics of the crypto market. (arxiv.org)

Advantages of Network-Based Strategies

-

Enhanced Diversification: By focusing on less correlated assets, these strategies can reduce portfolio risk.

-

Adaptability: Network structures can evolve with market conditions, allowing portfolios to adjust to changing correlations.

-

Data-Driven Insights: The approach relies on empirical data, providing a grounded method for asset selection.

Considerations and Limitations

While network-based strategies offer promising results, they are not without challenges. The crypto market’s inherent volatility means that past correlations may not always predict future relationships. Additionally, the computational complexity of network analysis can be resource-intensive. Investors should also be cautious of overfitting models to historical data, which can lead to poor out-of-sample performance.

Conclusion

Incorporating network-based strategies into cryptocurrency portfolio construction provides a sophisticated method to navigate the complexities of the digital asset landscape. By understanding and leveraging the intricate relationships between cryptocurrencies, investors can build portfolios that are both diversified and responsive to market dynamics. As the crypto market continues to mature, such innovative approaches will likely become increasingly valuable in achieving optimal investment outcomes.

References

-

Jing, R., & Rocha, L. E. C. (2023). A network-based strategy of price correlations for optimal cryptocurrency portfolios. Finance Research Letters, 58, 104503. (arxiv.org)

-

Kitanovski, D., Mishkovski, I., Stojkoski, V., & Mirchev, M. (2024). Network-based diversification of stock and cryptocurrency portfolios. Applied Network Science, 9(1), 1-20. (appliednetsci.springeropen.com)

-

López de Prado, M. (2016). Building diversified portfolios that outperform out of sample. The Journal of Portfolio Management, 42(4), 59-69. (en.wikipedia.org)

-

Tadi, M., & Kortchemski, I. (2023). Profitable arbitrage with dynamic cointegration in cryptocurrencies. Axon Trade. (axon.trade)

-

Clemente, G. P., Grassi, R., & Hitaj, A. (2019). Smart network-based portfolios. Applied Network Science, 4(1), 1-15. (arxiv.org)

-

Gregnanin, M., Zhang, Y., De Smedt, J., & Parton, M. (2024). Signature-based portfolio allocation: A network approach. Applied Network Science, 9(1), 1-20. (link.springer.com)

Be the first to comment