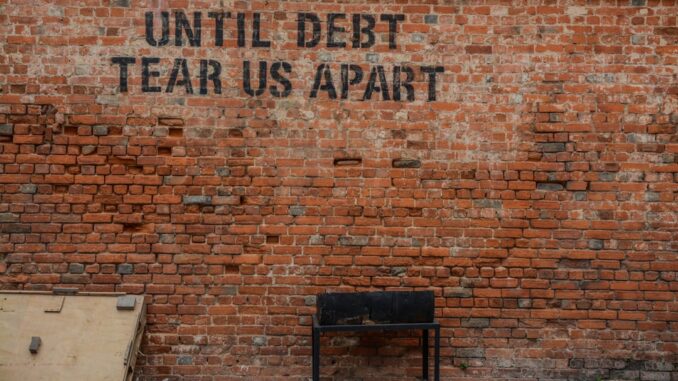

The hum of the national debt clock, ticking ever upwards, serves as a relentless backdrop to the current fiscal landscape. It’s a sound that probably keeps Treasury Secretary Scott Bessent awake at night, just as it gnaws at the collective consciousness of the nation. His recently unveiled debt reduction strategy, ambitious doesn’t even begin to cover it, truly mirrors a fascinating array of past fiscal approaches. But the real question, the one that hangs heavy in the air, isn’t just about its ambition, is it? It’s about its sheer sustainability, its long-term viability in a world that feels increasingly unpredictable.

Bessent’s blueprint, if you’ve been following the financial news, is a multifaceted beast. It leverages everything from the blunt instrument of tariffs to the subtle art of influencing monetary policy, all while placing a hefty bet on the transformative power of economic growth and even dabbling in the nascent world of digital currencies. Critics, as you might expect, are quick to draw fascinating, if sometimes unsettling, parallels to historical figures: the methodical brilliance of Albert Gallatin on one hand, and the speculative exuberance of John Law on the other. It’s a high-stakes gamble, isn’t it, replete with both tantalizing rewards and genuinely significant risks.

Assistance with token financing

Charting a New Course: Bessent’s Bold Fiscal Strategy

We’re talking about an administration that wants to slash the deficit down to a manageable 3% of GDP by 2028. Just think about that for a second. In an environment where the debt-to-GDP ratio feels like it’s perpetually climbing, this isn’t just a goal; it’s a statement of intent. Achieving it, however, requires a finely tuned, multi-pronged approach, each element carrying its own promise and its own peril.

Let’s break it down, shall we?

The Tariff Gambit: A Revenue Flood or a Trade War Tinderbox?

First up, the tariffs. These aren’t just minor adjustments; the administration has rolled out sweeping tariffs on a range of imports, and the early returns are, frankly, eye-popping. In the second quarter of 2025, customs duties alone reportedly brought in a whopping $64 billion. That’s nearly $50 billion more than the same period last year. Imagine that kind of cash injection. It’s like finding an unexpected gold seam in your backyard.

But let’s be pragmatic for a moment. While this surge in revenue certainly looks promising on paper, it inevitably sparks deep concerns about potential trade tensions. We’re already seeing the rumblings. Will other nations retaliate, sparking a full-blown trade war? And what about the inflationary pressures? Tariffs, after all, are essentially taxes on consumers, isn’t it? They increase the cost of imported goods, pushing up prices for businesses and households alike. I remember just last month, a friend who runs a small manufacturing business was telling me about the headache of sourcing raw materials from overseas now, saying ‘It’s not just the added cost, it’s the uncertainty, the constant worry about the next wave of duties that makes planning almost impossible.’ It’s a delicate balance, trying to shore up the domestic balance sheet without upsetting the global apple cart.

Moreover, the economic impact of tariffs often extends far beyond immediate revenue. They can disrupt intricate global supply chains, forcing businesses to scramble for new, often more expensive, suppliers. This can lead to reduced efficiency, higher production costs, and ultimately, higher prices for consumers. For some industries, particularly those reliant on specialized components from abroad, the tariff burden can be crippling, potentially leading to job losses or reduced investment domestically. It’s a classic case of what you gain on the swings, you might lose on the roundabout.

Riding the Wave: The Bet on Exponential Economic Growth

Then there’s the audacious bet on robust economic growth. The White House Council of Economic Advisers has painted a rather rosy picture, projecting a significantly larger U.S. economy over the next decade. The primary drivers, as envisioned by Bessent’s team, are threefold: massive investments in artificial intelligence, a sweeping program of deregulation, and targeted tax incentives.

Think about the AI piece for a moment. The argument goes that AI isn’t just a technological marvel; it’s a productivity multiplier. Imagine entire industries becoming vastly more efficient, new sectors emerging seemingly overnight, and an explosion of innovation that cascades through the economy. This isn’t just about faster computers; it’s about fundamentally reshaping how we work, produce, and consume. And if history teaches us anything, it’s that major technological revolutions, think the industrial revolution or the internet boom, can indeed unlock unprecedented levels of prosperity.

Deregulation plays a complementary role here. The idea is to trim the fat, cut the red tape that supposedly stifles innovation and investment. This could involve streamlining environmental reviews for new projects, easing financial regulations to encourage lending, or simplifying labor laws to make hiring more flexible. The underlying philosophy is that less government interference means more business dynamism, more capital flowing into productive ventures, and ultimately, more jobs and higher incomes. It’s a familiar refrain for those who believe in the power of free markets.

Finally, the tax incentives are designed to grease the wheels of investment. We’re talking about potential R&D tax credits to spur innovation, accelerated depreciation rules to encourage capital expenditure, or even broad-based tax cuts aimed at encouraging businesses to reinvest profits rather than hoard them. The goal is simple: make it more attractive to build, expand, and innovate within the United States.

However, the skeptics aren’t entirely wrong to raise an eyebrow, are they? Such optimistic growth assumptions can sometimes feel less like projections and more like wishful thinking. Economic growth, while generally beneficial, is also subject to global shocks, unforeseen challenges, and the inherent unpredictability of human behavior. Can AI deliver on such grand promises without significant social disruption? Will deregulation lead to genuine growth or simply greater financial instability down the line? These are questions without easy answers, and the stakes couldn’t be higher.

A Tug-of-War with the Fed: Lowering Borrowing Costs

Perhaps one of the most controversial elements of Bessent’s plan involves a subtle, yet undeniable, pressure campaign directed at the Federal Reserve. The logic is straightforward: lower interest rates mean a lower cost of servicing the colossal public debt. Every basis point reduction translates into billions saved annually. It’s a simple mathematical truth, yet the implications are anything but.

The administration has floated proposals to relax certain banking regulations, specifically those that might allow banks to hold significantly more Treasury bonds. The theory here is that if banks have less restrictive capital requirements or can count Treasuries more favorably towards their liquidity buffers, they’ll have a greater appetite for government debt. Increased demand, naturally, would help keep bond yields, and therefore borrowing costs, lower. It’s a clever mechanism, designed to create a captive market for government bonds.

But this approach sends shivers down the spine of anyone concerned about the Federal Reserve’s cherished independence. The Fed, traditionally, operates at arm’s length from political influence precisely so it can make tough, long-term decisions about monetary policy without succumbing to short-term electoral pressures. When the Treasury Secretary is openly advocating for specific interest rate policies or regulatory changes that directly benefit the government’s balance sheet, it certainly blurs those lines. You’ve got to ask yourself, doesn’t it feel a bit like the fox guarding the hen house when the Treasury is pushing for policies that reduce its own borrowing costs, potentially at the expense of broader financial stability or inflation control?

Furthermore, relaxing banking regulations, while potentially boosting demand for Treasuries, also carries inherent risks. The 2008 financial crisis, let’s not forget, was partly fueled by a lack of stringent oversight. Opening the door to banks holding more government debt, particularly if capital buffers are simultaneously weakened, could introduce new systemic vulnerabilities. It’s a delicate dance between fiscal expediency and financial prudence, and one that demands extreme caution.

The Digital Frontier: U.S.-Backed Stablecoins and the GENIUS Act

Finally, there’s the truly innovative, some might say audacious, push for U.S. dollar-backed stablecoins, championed through something called the GENIUS Act. This isn’t just about cryptocurrency novelty; it’s a strategic move to attract foreign capital and, yes, further lower government borrowing costs. Think about it: a stablecoin pegged directly to the U.S. dollar, backed by reserves held in safe, liquid assets like Treasuries. It’s essentially a digital IOU from the U.S. government, offering the stability of the dollar with the speed and efficiency of blockchain technology.

The premise is compelling: if foreign investors and central banks can easily hold U.S. dollar-denominated assets in a digital, easily transferable form, it enhances the dollar’s global standing. It makes holding U.S. debt more attractive, potentially increasing demand for Treasuries and driving down yields. For countries looking for a safe harbor for their reserves, or for businesses engaging in cross-border trade, a reliable, digitally native U.S. dollar could be incredibly appealing. It could even reduce reliance on traditional banking intermediaries, cutting down on transaction costs and delays.

However, it’s this element that perhaps most strongly echoes historical attempts at monetary innovation that, let’s be blunt, ended in spectacular financial instability. While the concept is certainly modern, the underlying desire to create new forms of money to manage public debt isn’t new at all. There’s a real danger here of creating parallel financial systems, of regulatory arbitrage, and of unforeseen systemic risks if a major stablecoin issuer were to face a crisis. It’s truly venturing into uncharted territory, isn’t it? And uncharted waters are rarely without their hidden rocks.

Echoes Through Time: Historical Precedents and Cautionary Tales

As you delve deeper into Bessent’s strategy, it’s impossible to ignore the ghosts of fiscal policies past. The echoes of history are loud, offering both inspiring precedents and stark warnings.

The Prudent Architect: Albert Gallatin and the Foundations of Fiscal Health

Let’s first consider Albert Gallatin, a towering figure from the early 19th century. As Treasury Secretary under Presidents Jefferson and Madison, Gallatin faced a nation burdened by debt from the Revolutionary War and an economy still finding its footing. Yet, it was Gallatin who meticulously financed the Louisiana Purchase, a massive territorial expansion that literally doubled the size of the young United States, through innovative bond issues. What made his approach visionary wasn’t just the outcome, but the process.

Gallatin was a staunch advocate for fiscal discipline. He believed in minimizing public debt, meticulously tracking expenditures, and ensuring transparency in government finances. He issued bonds with longer maturities and structured them to appeal to a broader base of investors, thereby expanding the nation’s creditworthiness. He wasn’t afraid to use customs duties as a primary source of revenue, much like Bessent’s tariffs, but his approach was always characterized by prudence and a clear, long-term vision. He understood that a nation’s financial credibility was its most valuable asset, and he built that trust brick by brick. His methodical approach to public finance laid the groundwork for future stability, proving that sound management could facilitate grand national endeavors.

The Speculative Dreamer: John Law and the Mississippi Bubble

Then there’s the cautionary tale of John Law, an 18th-century Scottish financier who, armed with a captivating vision and a brilliant mind for numbers, convinced the Regent of France to adopt his radical monetary system. France, at the time, was reeling from the colossal debts incurred during the War of the Spanish Succession. Law proposed a solution: introduce paper money backed by the wealth of the Mississippi Company, which held monopoly trading rights over the vast French territories in North America. This company also took over much of France’s national debt, converting it into shares in the company.

Law’s scheme was initially a roaring success. The infusion of paper money stimulated the economy, stock prices soared, and a wave of irrational exuberance swept through Paris. Fortunes were made overnight; the Mississippi Company’s shares went parabolic. It was a classic speculative bubble, fueled by easy money and the tantalizing promise of unimaginable wealth from the New World. People lined up for blocks, desperate to buy shares, convinced they couldn’t lose. Sound familiar? It’s a powerful reminder of how human psychology can amplify market movements, both up and down.

But the dream, inevitably, turned into a nightmare. Law printed far too much paper money, unmooring it from any real underlying value. The company’s promised riches from Louisiana failed to materialize. When doubts began to surface, a panicked sell-off ensued. The bubble burst with catastrophic force, collapsing the French financial system and leaving widespread ruin in its wake. Law fled in disgrace, and the experience left France deeply wary of paper money and central banking for generations. His aggressive monetary policies serve as a chilling reminder of the inherent risks when fiscal strategies become untethered from economic reality, particularly when they involve novel forms of money or debt restructuring schemes that rely too heavily on future, unproven wealth.

It’s this parallel to John Law’s misadventure that really hits home when considering Bessent’s stablecoin initiative. Both involve a fundamental restructuring of debt and the introduction of new monetary instruments to address pressing fiscal challenges. While stablecoins are designed to be, well, ‘stable,’ the rapid adoption and the potential for a global scramble for yield could lead to unforeseen consequences, much like the speculative fever that engulfed Law’s France. You can’t help but wonder if we’ve truly learned enough from history, can you?

Navigating the Treacherous Waters: Risks and Rewards Reconsidered

Bessent’s plan, while offering tantalizing potential benefits, isn’t without its own set of significant, interwoven risks. It’s a complex equation, and miscalculating any variable could lead to unintended, perhaps severe, consequences.

The Inflationary Specter: Erosion of Purchasing Power

One of the most immediate and palpable concerns is the specter of inflationary pressures. Let’s trace how this could happen. First, you have increased government spending, a potential consequence of an aggressively expanding economy and perhaps even some of the debt service savings being reinvested elsewhere. Then, factor in the tariff-induced price hikes; businesses pass on the increased import costs to consumers, and that’s a direct hit to your wallet, isn’t it? Couple that with monetary expansion, whether through lower interest rates or the widespread adoption of new digital currencies like stablecoins that increase liquidity. This potent cocktail could lead to a significant rise in the general price level, eroding purchasing power and hitting those on fixed incomes or with limited savings the hardest. Imagine watching your grocery bill climb steadily, or seeing your retirement savings buy less and less. It’s a fear that resonates deeply with many.

Moreover, if inflation takes hold, it creates a tricky situation for the Federal Reserve. Its dual mandate is price stability and maximum employment. If the administration’s policies are pushing inflation upwards, the Fed would typically respond by raising interest rates to cool the economy. But doing so would directly contradict Bessent’s goal of lower borrowing costs for the government, potentially creating a direct clash between monetary and fiscal policy. It’s a standoff nobody wants to see, and it’s one that could undermine confidence in both institutions.

Financial Market Reactions: A Jittery Global Stage

Financial markets, notoriously fickle and forward-looking, are constantly weighing risk. If investors perceive that the U.S. government is playing fast and loose with its fiscal health, or if they lose confidence in the Federal Reserve’s independence, they could demand higher yields on U.S. debt. This means the government would have to pay more to borrow money, completely negating Bessent’s efforts to reduce debt service costs. It’s a vicious cycle: higher perceived risk leads to higher borrowing costs, which then exacerbates the debt problem, further increasing perceived risk.

Furthermore, a significant sell-off in U.S. Treasuries, often considered the safest asset in the world, could ripple through global financial markets. Think about it: pension funds, central banks, and institutional investors worldwide hold trillions in U.S. debt. A sudden drop in bond prices, or a sharp increase in yields, could trigger a broad market correction, impacting everything from equity markets to corporate bond issuance. The U.S. dollar, currently the world’s reserve currency, could also come under pressure if confidence in its underlying stability begins to waver. It’s a big ‘if,’ but it’s one that keeps financial strategists up at night.

International Relations: Trade Wars and Digital Currency Diplomacy

Finally, we have the international dimension. The aggressive use of tariffs could easily escalate into tit-for-tat trade wars, harming global trade flows and potentially leading to a fragmentation of the global economy. No country wants to be on the receiving end of punitive duties, and retaliation is often the predictable response. We’ve seen this movie before, haven’t we? It rarely ends with everyone holding hands and singing ‘Kumbaya.’ Instead, it can lead to reduced global growth, strained diplomatic relations, and increased geopolitical instability.

Then there’s the promotion of U.S.-backed stablecoins. While seemingly benign, this initiative could be perceived by other nations as a strategic move to solidify U.S. financial hegemony in the digital age. Countries that are developing their own central bank digital currencies (CBDCs) or trying to reduce their reliance on the U.S. dollar might view the GENIUS Act as a competitive threat rather than a cooperative venture. It could spur a digital currency arms race, leading to a more fractured global financial system where different digital ecosystems compete for dominance, rather than collaborate. This isn’t just about finance anymore; it’s about geopolitics, and every move on the economic chessboard has wider implications.

Conclusion: A High-Wire Act in a Shifting World

Treasury Secretary Scott Bessent’s debt reduction strategy is undeniably a bold attempt, a high-wire act really, to address the nation’s colossal fiscal challenges. By drawing on both the astute lessons of history, like Gallatin’s prudence, and embracing innovative, yet potentially risky, new tools like stablecoins, the plan seeks a delicate balance between supercharging economic growth and bringing the national debt under control. It’s an enviable task, to say the least.

However, its ultimate success won’t just hinge on the elegance of the theoretical framework. It will depend, crucially, on the meticulous execution of each component, the uncanny ability to navigate unpredictable economic currents, and the political will to stay the course even when faced with significant headwinds. Will Bessent be remembered as a modern-day Gallatin, the architect of a new era of fiscal stability? Or will he inadvertently tread too close to the speculative excesses that brought down John Law? Only time will tell, but one thing’s for sure: the world will be watching, and the stakes for the U.S. economy, and indeed the global financial system, couldn’t be higher.

Be the first to comment