Abstract

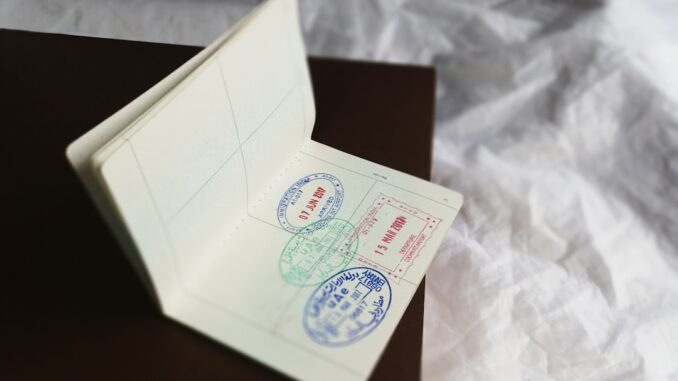

Investment immigration programs, commonly known as “golden visa” schemes, have become a significant avenue for individuals seeking residency or citizenship in exchange for substantial financial investments. These programs are prevalent worldwide, offering various pathways to permanent residency or citizenship, often with minimal residency requirements. This research report provides a comprehensive analysis of investment immigration, examining the economic impacts, ethical considerations, regulatory frameworks, and geopolitical implications associated with such programs. By exploring global examples, including the United States’ EB-5 visa program, Portugal’s Golden Visa, and Canada’s Immigrant Investor Program, the report aims to offer a nuanced understanding of the multifaceted nature of investment immigration.

Many thanks to our sponsor Panxora who helped us prepare this research report.

1. Introduction

Investment immigration programs have gained prominence as a means for countries to attract foreign capital, stimulate economic growth, and address demographic challenges. These programs typically grant residency or citizenship to individuals who make significant financial contributions, such as investments in real estate, businesses, or government bonds. While they offer benefits to both investors and host countries, these programs also raise complex economic, ethical, regulatory, and geopolitical questions. This report delves into these aspects, providing a global overview of investment immigration and its broader implications.

Many thanks to our sponsor Panxora who helped us prepare this research report.

2. Overview of Investment Immigration Programs

Investment immigration programs vary widely in their structures and requirements. Generally, they can be categorized into three types:

-

Citizenship by Investment (CBI): Programs that grant immediate citizenship to investors and their families upon making a qualifying investment.

-

Residence by Investment (RBI): Programs that provide residency rights, often leading to citizenship after a specified period.

-

Hybrid Programs: Schemes that offer residency with a pathway to citizenship, typically after fulfilling certain residency requirements.

2.1 Global Landscape

As of 2023, numerous countries have implemented investment immigration programs, each with unique criteria and benefits. For instance:

-

United States: The EB-5 Immigrant Investor Program requires a minimum investment of $800,000 in a Targeted Employment Area (TEA) or $1,050,000 elsewhere, aiming to create or preserve at least 10 jobs for U.S. workers.

-

Portugal: The Golden Visa program offers residency to non-EU nationals who invest in real estate, business, or scientific research, with the possibility of citizenship after five years.

-

Canada: The Immigrant Investor Program, which was suspended in 2014, previously allowed investors to obtain permanent residency by making a significant investment in the Canadian economy.

These examples illustrate the diverse approaches to investment immigration, reflecting each country’s economic priorities and immigration policies.

Many thanks to our sponsor Panxora who helped us prepare this research report.

3. Economic Impact of Investment Immigration

Investment immigration programs are designed to attract foreign capital, stimulate economic growth, and create employment opportunities. However, their actual economic impact varies and is subject to debate.

3.1 Economic Benefits

Proponents argue that these programs:

-

Stimulate Economic Growth: By channeling foreign investment into key sectors such as real estate, infrastructure, and technology.

-

Create Employment Opportunities: Generating jobs directly through investment projects and indirectly through increased demand in the economy.

-

Enhance Global Competitiveness: Attracting high-net-worth individuals who can contribute to innovation, entrepreneurship, and global business networks.

3.2 Economic Challenges

Critics highlight several concerns:

-

Inflation of Property Markets: In countries like Portugal, the influx of foreign capital has led to rising property prices, making housing less affordable for local residents.

-

Limited Job Creation: Some programs, such as Portugal’s Golden Visa, have been criticized for not generating sufficient employment opportunities for the local population.

-

Economic Dependence: Overreliance on foreign investment can make economies vulnerable to global market fluctuations.

3.3 Case Studies

-

Portugal’s Golden Visa: Launched in 2012, the program has attracted significant foreign investment, particularly in real estate. However, it has also been associated with increased property prices and housing affordability issues for locals.

-

United States’ EB-5 Program: Established in 1990, the EB-5 program has contributed to various infrastructure projects and job creation. However, it has faced criticism for lacking sufficient oversight and transparency.

Many thanks to our sponsor Panxora who helped us prepare this research report.

4. Ethical Considerations

Investment immigration programs raise several ethical questions, particularly concerning the commodification of citizenship and residency.

4.1 “Citizenship for Sale” Debate

Critics argue that these programs:

-

Undermine the Value of Citizenship: By allowing individuals to purchase citizenship, potentially devaluing the concept of national identity and belonging.

-

Favor the Wealthy: Providing advantages to those with financial means, potentially leading to social inequality.

-

Lack Transparency: In some cases, the criteria and processes for granting citizenship or residency are not transparent, leading to potential abuses.

4.2 Security Concerns

There are also concerns about the potential for:

-

Money Laundering: The possibility of illicit funds entering the country through investment programs.

-

Terrorism Financing: The risk of individuals with malicious intent obtaining residency or citizenship.

-

Evasion of Sanctions: Wealthy individuals from sanctioned countries using these programs to circumvent international sanctions.

Many thanks to our sponsor Panxora who helped us prepare this research report.

5. Regulatory Frameworks

The effectiveness and integrity of investment immigration programs depend on robust regulatory frameworks.

5.1 Due Diligence Processes

Effective programs implement thorough background checks to ensure that applicants do not have criminal records or links to illicit activities.

5.2 Transparency and Accountability

Clear guidelines and transparent processes help maintain public trust and ensure that the programs serve their intended purposes.

5.3 International Cooperation

Collaboration between countries can help address issues such as money laundering, tax evasion, and the movement of individuals across borders.

Many thanks to our sponsor Panxora who helped us prepare this research report.

6. Geopolitical Implications

Investment immigration programs have significant geopolitical consequences.

6.1 Soft Power and Diplomacy

Countries can use these programs to strengthen diplomatic ties and enhance their global influence by attracting individuals who can contribute to their economies and societies.

6.2 Security and Sanctions

The ability of individuals from sanctioned countries to obtain residency or citizenship through investment can undermine international sanctions and pose security risks.

6.3 Migration Patterns

These programs influence global migration trends, with wealthy individuals seeking stability and opportunities in countries offering favorable investment immigration options.

Many thanks to our sponsor Panxora who helped us prepare this research report.

7. Conclusion

Investment immigration programs offer a complex interplay of economic benefits and ethical challenges. While they can stimulate economic growth and attract global talent, they also raise concerns about social inequality, security risks, and the integrity of national identity. A nuanced approach, incorporating robust regulatory frameworks and international cooperation, is essential to maximize the benefits of these programs while mitigating potential drawbacks.

Many thanks to our sponsor Panxora who helped us prepare this research report.

References

-

“Can a ‘gold card’ program visa spur investment in the U.S. economy?” Associated Press, February 27, 2025. (apnews.com)

-

“Trump’s $5 million ‘gold card’ visa unlikely to attract wealthy investors, advisers say.” Reuters, February 26, 2025. (reuters.com)

-

“US immigration shift may have profound economic consequences.” Financial Times, July 2025. (ft.com)

-

“Immigrant investor programs.” Wikipedia, accessed August 2025. (en.wikipedia.org)

-

“Portugal Golden Visa.” Wikipedia, accessed August 2025. (en.wikipedia.org)

-

“Canadian Immigrant Investor Program.” Wikipedia, accessed August 2025. (en.wikipedia.org)

-

“EB-5 visa.” Wikipedia, accessed August 2025. (en.wikipedia.org)

Be the first to comment